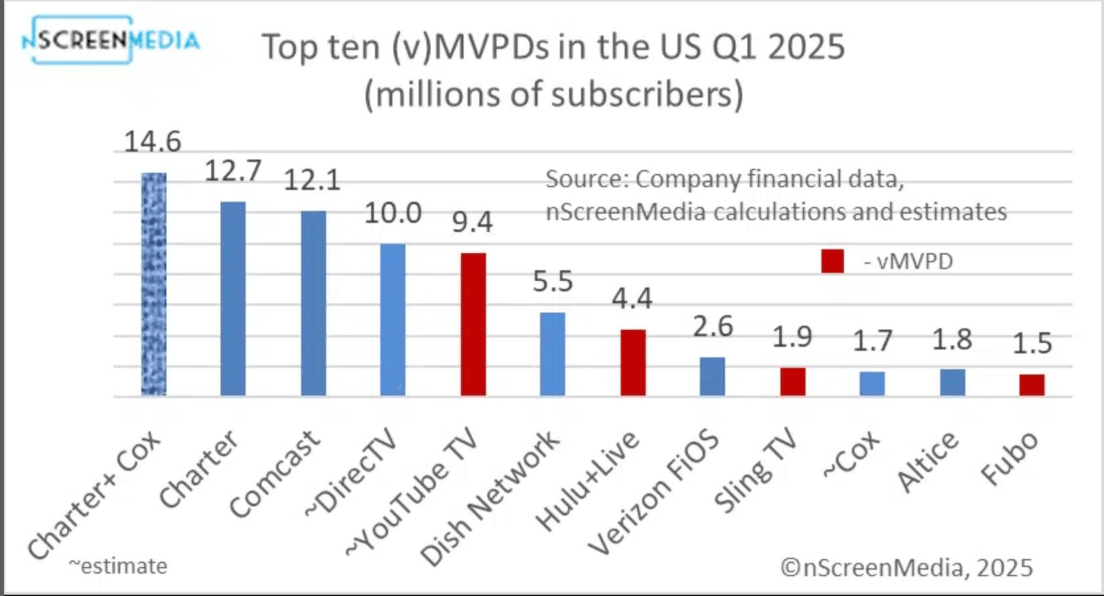

People working in digital media may assume traditional TV is already out of the picture. But recent data from nScreenMedia shows that major MVPDs (Multichannel Video Programming Distributors) still command serious reach.

Charter and Cox, combined, have 14.6 million subscribers. That’s more than Comcast and far ahead of any virtual provider. YouTube TV (the largest vMVPD) has 9.4 million subscribers by comparison. That kind of scale still matters.

Charter and Cox’s subscriber base gives them strong leverage across the distribution ecosystem. When leagues or networks negotiate content rights, scale is key. With 14.6 million homes, these two providers remain must-have partners. This reach helps secure better terms for content deals, sports rights, and advertising. It also means that being dropped from a provider like Charter or Cox can result in millions of lost viewers for a network.

Still, streaming is gaining momentum. YouTube TV’s 9.4 million subscribers is a major milestone, especially for a platform that only launched in 2017. And while legacy MVPDs still lead in raw subscriber numbers, trends are shifting. Streaming services offer better UX, platform flexibility, and on-demand viewing. Younger audiences are increasingly skipping traditional cable entirely. As broadband expands and new content models evolve, growth may outpace current industry projections.

Charter and Cox remain powerful players. Their scale and bundled offerings make them hard to ignore. But they are operating in a market that is shifting fast. Streaming providers haven’t surpassed them yet—but they are getting closer each quarter. The race is tighter than many think.

Sam Khoury

Founder, Cedar Consultants

Creative consulting solutions for Adtech